IHG Vs. Hilton – Which Is Better?

Once upon a time, I would have never considered the IHG Rewards Club. IHG, otherwise known as InterContinental Hotels Group, is the parent company of the Holiday Inn, along with other brands. I know, I know! You immediately think of the reputation that the Holiday Inn had. None of us want to be associated with the 90’s low-budget borderline motel full of undesirable clientele. Unsure at first, but things have changed!

I am a frequent traveler and use a variety of hotel chains, the main two being IHG and Hilton. I am a member of both programs and use them very differently, so which is a better loyalty program, IHG Vs. Hilton Honors?

This post may contain affiliate links. Please read our disclosure and privacy policy for more information.

I spent a summer in Sioux Falls on business. The hotel of choice was the Holiday Inn because the Hilton in Sioux Falls was overpriced. I was impressed by my first stay at a Holiday Inn in years!

Holiday Inn has come a long way over the years. Modern, spacious rooms and resort amenities. Lush bedding and premium toiletries. What more can you ask for? Best of all, affordable. Since I stayed there almost every summer, I signed up for the IHG Rewards Club and scored many points.

Then, once I understood the ease of accumulating and redeeming points, I also signed up for the IHG® Rewards Club Premier Credit Card. To this day, it’s one of my favorite travel credit cards.

IHG Vs. Hilton Honors

Now comes the cool part! The point redemption of IHG is a lot less than Hilton. I can stretch my redemptions further using IHG vs Hilton Honors.

For example, it is 30,000 points for an oceanfront room at Vero Beach, vs. Hiltons, which is 50,000 to 60,000 for comparable properties.

Another example. The office I once worked from in Chicago is next door to the Kimpton Chicago, which IHG once owned. Kimpton properties are divine and will give any luxury chain a run for its money!

*Note: The Chicago Kimpton is no longer a part of the IHG portfolio.

You may not have heard of the Kimpton brand, so here are a few photos from one property in Chicago. This gives you a great idea of what to expect from Kimpton and why you need to weigh up IHG Vs. Hilton brands:

The Switch from Hilton Honors to IHG Rewards Club

I am a die-hard Hilton fan. I have Diamond status with Hilton, which brings tons of perks—the mere thought of comparing IHG Vs. Hilton once gave me heartburn. Regardless, if you use the Hilton co-branded American Express credit card. At one point, Hilton was my go-to chain. Still loyal, I have some issues with Hilton:

- They always have lower prices listed on 3rd party sights that they will not honor without going through the best price match process, which is a sham.

Some people claim to have had sucess using the best price match – I never have.

- Point redemption for Hilton properties has skyrocketed. Gone are the days when you could get a room for less than 30,000 points. Long gone are the days of 30,000 at the beach. I’m finding it impossible to get redemptions under 50,000 these days for the lower-end brands like Hampton Inn vs. actual Hilton Hotels.

- I rarely got upgraded at Hilton without a high-ranking status, and acquiring Diamond status without a co-branded credit card has become more challenging.

- Hilton’s room prices have increased significantly. Even during COVID, they were astronomical and have continued to climb.

- Many properties in the Hilton portfolio are franchises. Service, quality, and amenities vary wildly. I find this one exceptionally annoying!

Hilton’s only remaining unbeatable benefit is the 5th-night free opinion when redeeming a point stay. This can be lucrative if you use it at higher-end properties regarding IHG Vs. Hilton – this is a definite pro for Hilton.

It’s also worth mentioning that if you have the Hilton American Express credit card, you earn free nights (not points) based on spending. Another benefit that can tip the debate on IHG Vs. Hilton.

Combining the IHG credit card and being a member of the IHG Club became a game changer for me. The IHG credit card is not the one you hear everyone talking about. I think it gets overlooked because of the Holiday Inn’s reputation. And because people don’t know which brands are part of the IHG family.

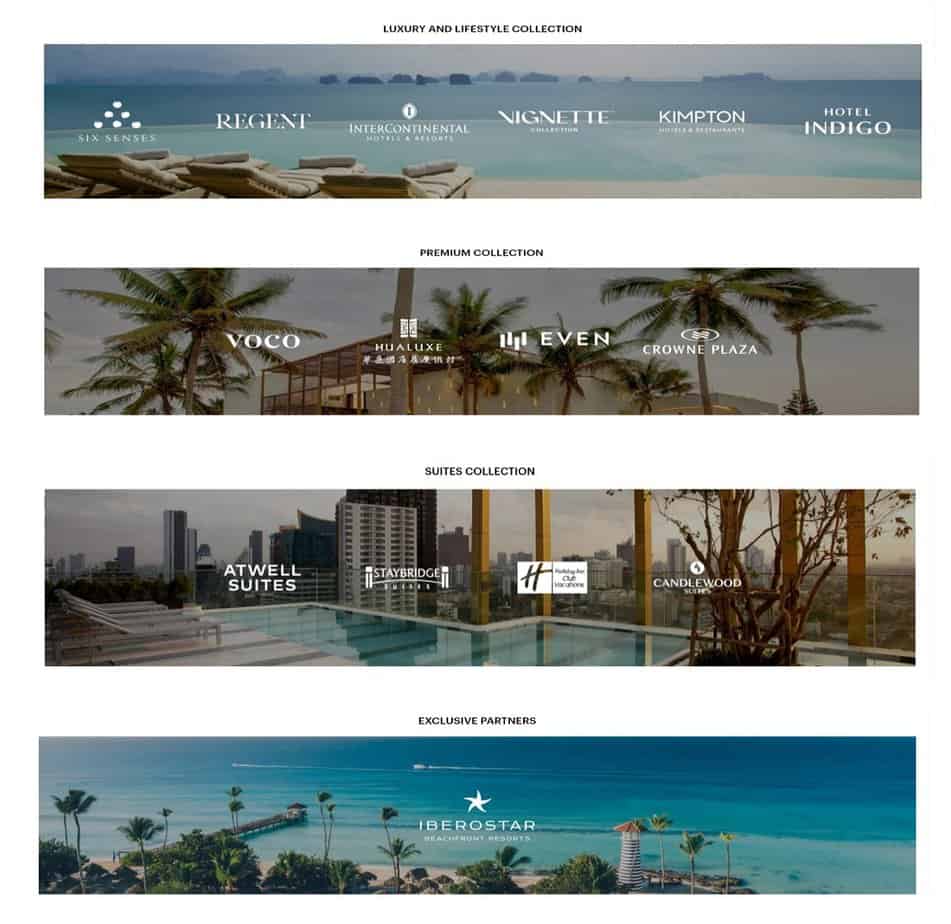

The IHG Brands

Look at all the choices that the IHG brings us! Check some of these out. As with all brands, they range from budget to luxury; there is something here for everyone.

- Atwell Suits

- Avid™ hotels

- Candlewood Suites®

- Crowne Plaza® Hotels & Resorts

- EVEN® Hotels

- Garner

- Hauluxe

- Holiday Inn

- Holiday Inn Express®

- Hotel Indigo®

- HUALUXE® Hotels and Resorts

- Iberostar Beachfront Resorts

- InterContinental® Hotels & Resorts

- Kimpton® Hotels & Restaurants

- Regent® Hotels & Resorts

- Six Senses

- Staybridge Suites®

- Vignette

- Vovo

IHG Rewards Club Credit Cards Compared

Chase offers two IHG cards: the IHG® Rewards Club Traveler Credit Card and the IHG® Rewards Club Premier Credit Card.

Both are fantastic cards, but in my opinion, the IHG® Rewards Club Premier Credit Card is worth the $99 annual fee for two key reasons:

- The annual free night

- The automatic Platinum Elite Status

Here are the two IHG credit cards compared side by side:

| IHG® Rewards Club Traveler Credit Card | IHG® Rewards Club Premier Credit Card | |

| Annual Fee | 0 | $99 |

| Points Earning at IHG | 5X points at IHG properties 5X total points at IHG® Hotels and Resorts worldwide when you combine your IHG® card benefits with existing IHG® Rewards Club member benefits 5X points with the card when you stay at any hotel in the IHG® family of brands 10X points from IHG® for being an IHG® Rewards Club member | 10X points at IHG properties 10X points at IHG® Hotels and Resorts as an IHG® Rewards Club Premier Credit Cardmember 10X points from IHG® for being an IHG® Rewards Club member 5X points from IHG® with Platinum Elite Status, a benefit of this card |

| Points Earning Everywhere Else | 3X points on gas, grocery, and restaurants | 5X points on gas, grocery, and restaurants |

| IHG Elite Status | Automatic Silver, upgraded to Gold if you spend $20,000 on the card within the calendar year. | Up to $600 per claim, and pay it with your eligible credit card. Maximum of 2 claims in 12 months with a $50 deductible per claim.d $1,000 per year in cell phone protection against covered theft or damage for phones listed on your monthly cell phone bill when you pay it with your eligible credit card. Maximum of 2 claims in 12 months with a $50 deductible per claim. |

| Free Night Anniversary | No free night. | Yes, one complimentary anniversary night per year. |

| Annual Bonus | No | 10,000 After $20,000 on purchases. |

| 4th Reward Night Free | Yes | Yes |

| 20% Discount on Points Purchase | Yes | Yes |

| Global Entry or TSA Pre✓® Fee Credit | No | The credit of up to $100 every four years as reimbursement for the application fee charged to your card |

| Foreign Transaction Fees | None | None |

| Auto Rental Collision Damage | Auto Rental Collision Damage Waiver | Auto Rental Collision Damage Waiver |

| Decline the rental company’s collision insurance and charge the entire rental cost to your card. Coverage is provided for theft and collision damage for most cars in the U.S. and abroad. In the U.S., coverage is secondary to your insurance. | Decline the rental company’s collision insurance and charge the entire rental cost to your card. Coverage is provided for theft and collision damage for most cars in the U.S. and abroad. In the U.S., coverage is secondary to your insurance. | |

| Baggage Delay Insurance | Reimburses you for essential purchases like toiletries and clothing for baggage delays over 6 hours by passenger carrier up to $100 a day for three days. | Reimburses you for essential purchases like toiletries and clothing for baggage delays over 6 hours by passenger carrier up to $100 a day for three days. |

| Lost Luggage Reimbursement | When you pay for your air, bus, train, or cruise transportation with your card, you can receive accidental death or dismemberment coverage of up to $500,000. | Decline the rental company’s collision insurance and charge the entire rental cost to your card. Coverage is provided for theft and collision damage for most cars in the U.S. and abroad. In the U.S., coverage is secondary to your insurance. |

| Purchase Protection | Covers your new purchases for 120 days against damage or theft up to $500 per claim and $50,000 per account. | Covers your new purchases for 120 days against damage or theft up to $500 per claim and $50,000 per account. |

| Trip Cancellation/Trip Interruption Insurance | Suppose your trip is canceled or cut short by sickness, severe weather, and other covered situations. In that case, you can be reimbursed up to $5,000 per person and $10,000 per trip for your pre-paid, non-refundable travel expenses, including passenger fares, tours, and hotels. | Suppose your trip is canceled or cut short by sickness, severe weather, and other covered situations. In that case, you can be reimbursed up to $5,000 per person and $10,000 per trip for your pre-paid, non-refundable travel expenses, including passenger fares, tours, and hotels. |

| Travel Accident Insurance | When you pay for your air, bus, train, or cruise transportation with your card, you can receive accidental death or dismemberment coverage of up to $500,000. | Up to $600 per claim and pay it with your eligible credit card. Maximum of 2 claims in 12 months with a $50 deductible per claim.d $1,000 per year in cell phone protection against covered theft or damage for phones listed on your monthly cell phone bill when you pay it with your eligible credit card. Maximum of 2 claims in 12 months with a $50 deductible per claim. |

| Cell Phone Protection | Get up to $600 per claim and $1,000 per year in cell phone protection against covered theft or damage for phones listed on your monthly cell phone bill. | Get up to $600 per claim and $1,000 per year in cell phone protection against covered theft or damage for phones listed on your monthly cell phone bill. |

What Does Platinum Elite Status Get You?

To earn the Platinum Elite, you must stay 40 nights or earn 60,000 base rewards each calendar year – not an easy task for most. And it’s worth having Platinum Elite.

From personal experience, I can tell you that I have received a room upgrade from over a hundred stays every single time except for once. The room upgrades are game-changers. You go from the cheapest available room to the lushest of suites available. I’ve had two-bedroom suites that were bigger than some houses, over 1,000 square feet!

Platinum Elite Benefits:

- Bonus point earnings on IHG stays.

- Room upgrades

- Complimentary Wi-Fi

- Spa, minibar, or dining credits

- Priority check-in

- Late check out

- Welcome amenity

The IHG Rewards Club Premier Credit Card

This credit card should be on your list if you consider a credit card! I earn tons of points that equal free stays, and I get Platinum status just for having the card. Here are the highlights:

- It has an annual fee of $99 a year annual fee. In return, you get a free anniversary night. I stayed at the Holiday Inn at Vero Beach during my free night.

- In 2018, Chase introduced the new IHG Rewards Club Premier Credit Card. The new card offers an annual free night certificate but caps the redemption value at 40,000 points. This applies to all reservations on or after January 25, 2019.

- In 2020, I used my free night at InterContinental The Clement Monterey. This hotel sells for an average of $312, which more than takes care of the $49 annual fee. I used this during spring break, which is also a prime time for travel.

- Earn 25 points for the IHG Rewards Club per dollar spent.

- Automatically become Platinum Elite within the IHG Rewards Club. This more or less guarantees you upgrades galore! If an upgrade is available, you automatically get it.

- The fourth night is free when you redeem points for four or more nights.

- No Foreign Transaction Fees.

- $100 towards Global Entry or TSA PreCheck.

- 80,000 – 140,000 bonus points sign up. Enough for an entire week if you play your cards right.

A Switch Back from IHG Rewards Club To Hilton Honors?

As much as I love IHG, I’ve recently begun using Hilton more often. There are a couple of reasons for this:

- The Hilton Honors American Express Card offers a lucrative signup.

- You can earn in dual-player mode and combine points. The dual-player mode means you and others can collect and bank points into one account.

- When using points, your fifth night is free.

- They have recently lowered point redemption values for a lot of international properties.

I am still all over IHG and think their point redemption outweighs Hiltons unless you earn extra free nights on a Hilton Credit Card.

Here’s a recent example of points redemption with Hilton:

Hilton London Syon Park – An Estate Stay In The Heart Of London

Before we dive into the details of super cool Hilton redemptions, know that you will likely get an upgrade if you have a decent status with Hilton Honors, no matter what. This said, for my stay at Syon Park in London, I did not spend a dime. I used another hack to accomplish this with Chase Points vs. Hilton Points.

For the first night, I used an anniversary night I earned from my Hilton American Express Credit Card. Then, I used Chase Ultimate Rewards Points. The conversion value using Chase points was less via Chase than Hilton. It cost me 17,000 Chase points a night using Chase Ultimate Rewards Points. If I had booked via Hilton and used Hilton points, it was 60,000 points per night.

Budapest, Hungary – My Favorite Hilton Points Redemption Ever

If you are not familiar with Budapest, you might not know that there is a district called Castle Hill. It sits atop the city, overlooking Parliament and the Danube River. It is also home to the Royal Palace and the Fisherman’s Bastion.

For a mere 42,000 points, this is what you can expect! To stay inside the Fisherman’s Bastion with this view:

The Hilton Brands

Look at all the choices that the Hilton brings us! Check some of these out. As with all brands, they range from budget to luxury; there is something here for everyone.

- Canopy by Hilton

- Conrad Hotels & Resorts

- Curio Collection by Hilton

- DoubleTree by Hilton

- Embassy Suites by Hilton

- Hampton by Hilton

- Hilton Garden Inn

- Hilton Grand Vacations

- Hilton Hotels & Resorts

- Home2 Suites by Hilton

- Homewood Suites by Hilton

- LXR Hotels & Resorts

- Motto by Hilton

- Signia by Hilton

- Tapestry Collection by Hilton

- Tempo by Hilton

- Tru by Hilton

- Waldorf Astoria Hotels & Resorts

Hilton Honors Rewards Club Credit Cards Compared

American Express offers three Hilton credit cards: Hilton Honors American Express Card, Hilton Honors American Express Surpass® Card, and Hilton Honors American Express Aspire Card.

Here are the three Hilton Honors Credit Cards compared side by side:

| Credit Card | Hilton Honors American Express Card | Hilton Honors American Express Surpass® Card | Hilton Honors American Express Aspire Card |

| Annual Fee | $0 See rates and fees | $95 | $450 |

| Bonus | Earn 130,000 Hilton Honors Bonus Points after spending $2,000 on purchases in the first three months | Earn 150,000 Hilton Honors Bonus Points after spending $4,000 in the first three months | Unlimited Priority Pass Select Lounge visits (registration required) |

| Earning rate | 7X points at participating hotels and resorts in the Hilton portfolio; 5X points at U.S. restaurants, U.S. supermarkets, and U.S. gas stations; and 3X points on all other eligible purchases | 12X points on eligible purchases at participating Hilton hotels or resorts; 6X points at U.S. restaurants, U.S. supermarkets, and U.S. gas stations; and 3X points on all other eligible purchases | 14X points on eligible purchases within the Hilton portfolio, 7X points on qualifying travel purchases made directly with airlines/select car rental companies or Amextravel.com, 7X points at U.S. restaurants, and 3X points on all other eligible purchases |

| Travel credits | None | None | $250 Hilton Resort statement credit |

| Honors status | Silver | Gold | Diamond |

| Free nights | None | Free Night Reward with spend | Annual Free Night Reward |

| Airport lounge access | None | 10 Priority Pass Select Lounge visits per year (enrollment required) | Unlimited Priority Pass Select Lounge visits (enrollment required) |

| Other perks | No foreign transaction fees Baggage insurance Car rental loss and damage insurance (secondary coverage) Extended warranty Purchase protection | No foreign transaction fees Baggage insurance Car rental loss and damage insurance (secondary coverage) Extended warranty Purchase protection | No foreign transaction fees Baggage insurance Car rental loss and damage insurance (secondary coverage) Extended warranty Purchase protection |

FAQs

Closing Thoughts

I’ve gone back and forth with IHG and Hilton. Once, I would have told you IHG all the way; however, the Hilton program has upped its game.

I’ve stayed in IHG properties in New Zealand, Australia, Florida, and Chicago, to name a few. 90% of the time, I get upgraded to a suite, which is luscious in all brands. I love the bedding, and I love the amenities. Most importantly, I love earning and favorably redeeming points as a member of the IHG Rewards Club.

So, to answer the question of which is best, IHG Vs. Hilton? For me, it’s still IHG! And if you don’t have a co-branded IHG card in your wallet, you are missing free travel!

Looking for more Travel Hacks? Start here:

- 5 Ways to Maximize Paid Time Off Work

- 6 Reasons To Choose An Inside Cruise Cabin

- 20 Best Ways to Earn Lots of Credit Card Rewards Points

- Disney World Resorts on A Dime

- Eight Travel Hacks That Are Bull

- Global Entry vs. TSA Precheck

- Multi-City Flights – A Travel Hack You Need to Know!

- Off-Season Travel – 14 Reasons to Consider It

- RCI Reservations – How to Make One

- Timeshare Resale – Why You Should Buy One

We participate in the Amazon Services LLC Associates Program, an affiliate advertising program designed to earn fees by linking to Amazon.com and affiliated sites.

Brit On The Move™ Travel Resources

Ready to book your next trip? Use these resources that work:

Was the flight canceled or delayed? Find out if you are eligible for compensation with AirHelp.

- Book your Hotel: Find the best prices; use Booking.com

- Find Apartment Rentals: You will find the best prices on apartment rentals with Booking.com’s Apartment Finder.

- Travel Insurance: Don’t leave home without it. View our suggestions to help you decide which travel insurance is for you: Travel Insurance Guide.

- Want to earn tons of points and make your next trip accessible? Check out our recommendations for Travel Credit Cards.

- Want To Take A Volunteer Vacation or a Working Holiday? Check out the complete guide to how here!

- Want to Shop For Travel Accessories? Check out our Travel Shop.

Need more help planning your trip? Visit our Resources Page, which highlights the great companies we use for traveling.